Table of Content

The bank will immediately reply with a message telling you what to do next. You can also write to DHFL Customer Care if you don’t want to call them or if the phone status update isn’t satisfactory. Send an email to with your inquiry, and you’ll get a response within 7 business days.

During a home loan application process, there is a lot of paperwork involved. Similarly, DHFL also requires legit documents for easy loan processing. Alternatively, the applicant may also visit the online website of DHFL. Once logged on to the website, the applicant has to select the home loan he wishes to apply for. After selecting the relevant home loan type, the applicant is redirected to a new page which holds all the necessary information regarding the loan process. Be it any event, eligibility comes first and is a deciding factor.

Piramal Home Loan Eligibility Criteria

Any Non – resident Indian based abroad, on an average, earns more and better than his Resident Indian counterparts. NRI Home Loans – Once an Indian, always an Indian. Keeping this in mind, DHFL has a separate scheme for those living abroad.

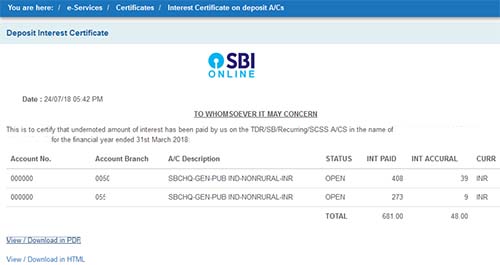

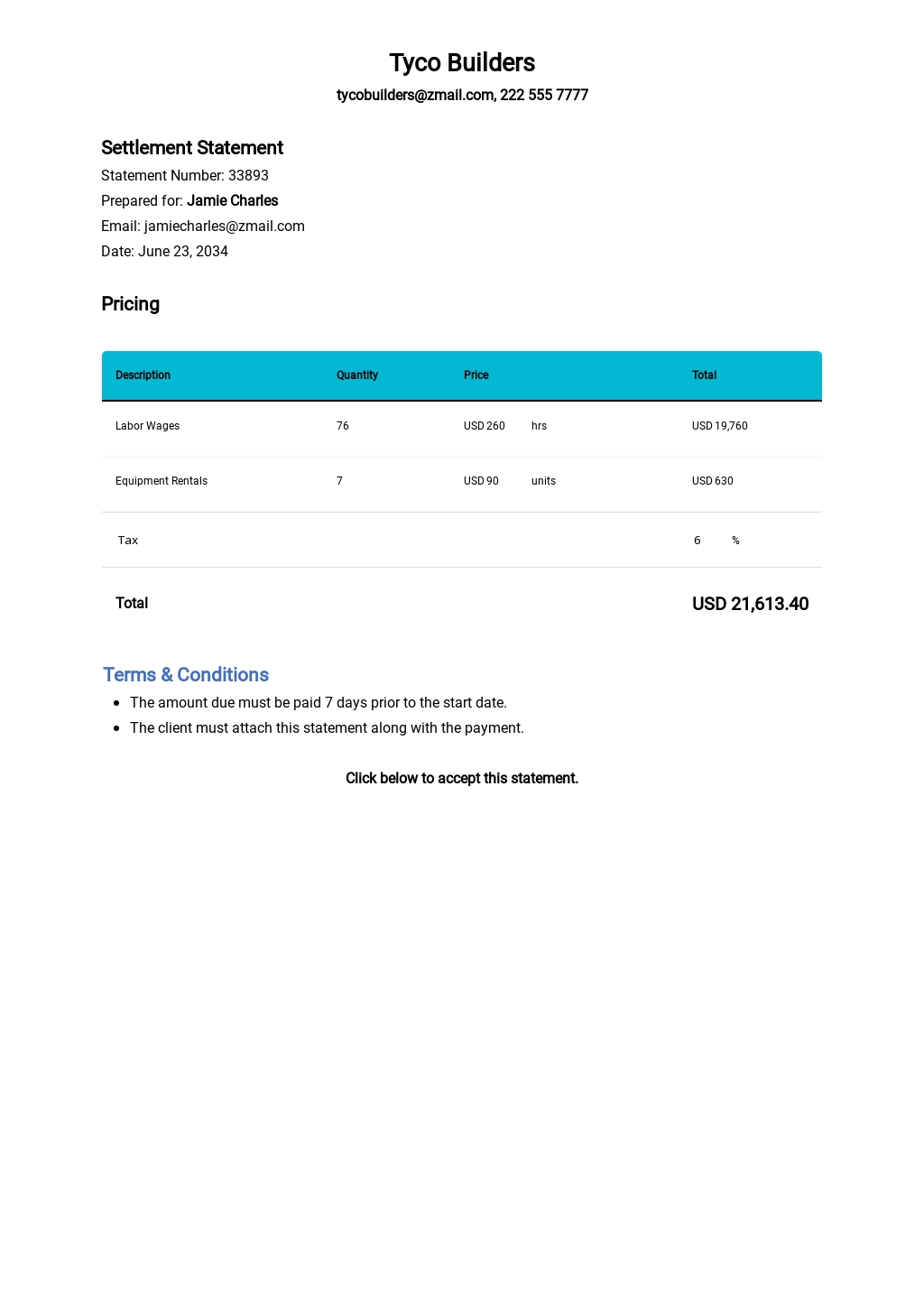

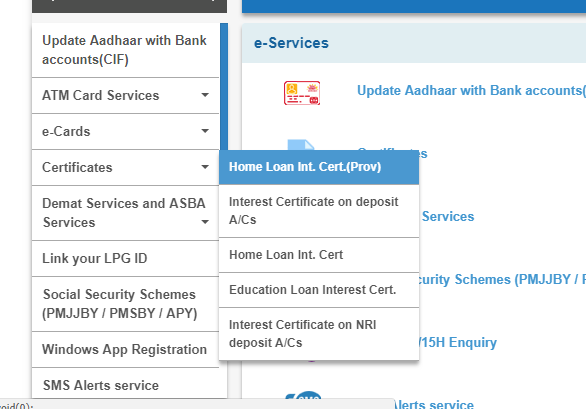

Existing customers of PFL can login to this app using their registered mobile number and enjoy host of services for loan account. The Cholamandalam Home Loan Interest Certificate is a document issued by the company mentioning the total interest paid on the Cholamandalam Home Loan during a particular financial year. DHFL home loan statement provides you with detailed insight into your outstanding balance and the total amount you have paid toward principal repayment and interest. Using this statement, you can manage your monthly budget precisely and never forget to settle your EMI on time. The home loan statement can also help you if your home loan deduction is being scrutinised by the Income Tax department. Piramal Retail Finance, the consumer lending platform of Piramal Enterprises Limited, engages in various financial services businesses.

Steps to Check DHFL Bank Home Loan Approval Status

The duly filled application form is to be accompanied by all the relevant documents and submitted to the concerned loan officer. However, it is advised in the good interest of the applicant that he should keep multiple copies of the relevant documents and also of the application form. The applicant is free to apply for the loan by either visiting DHFL’s branch office or logging on to the official website of the company. To check one’s eligibility, the applicant may visit any DHFL Branch and contact the loan officer.

This mentions the total interest payable on the Cholamandalam Home Loan during that particular financial year. This is usually required for planning income tax and also for managing other finances for the financial year. The Cholamandalam Home Loan statement or Repayment Schedule is easily available throughout the year.

What are the advantages of having a home loan certificate?

We have forwarded your query to our customer service team for resolution and they shall revert to you within 72 hours. Alternatively, you may call us on or email us at @dhfl.com. However, request you to share your email ID and mobile number as well to help us trace your issue and resolve it at the earliest. The procedure to apply for a Piramal home loan is quite easy.

DHFL’s Home Loan Balance Transfer can be used to transfer an existing home loan to a lower rate of interest so that your pocket is not affected. New Home Loans – The New Home Loan facility offered by DHFL can be used by a customer to purchase a ready built-up or under-construction house flat or resale property. Apart from exciting rates of interest, DHFL also has a scheme called Home Loan Balance Transfer using which can be used to transfer an existing home loan at a lower interest rate. Therefore, a high CIBIL score means that your borrowing and repayment habits are good and the lender can provide you with the loan without any worries. Fill in all the requested details, such as Home Loan Account Number, Applicant’s Date of Birth, Email ID and other contact details as applicable. Procuring a Home Loan statement from Cholamandalam is a simple process.

Documents Required by an NRI for DHFL Home Loan

However, higher rates of interest and lower loan tenures are far outweighed by the benefits that DHFL Home Loans for NRIs provide. The benefits include attractive rates of interest, lower processing fees, up to 80 % coverage of the property amount and a repayment period of up to 20 years. Magma HFL Home Loan customers have the option of procuring their home loan statement and interest certificate offline by visiting the nearest branch of Magma HFL. Piramal Capital & Housing Finance offers home loans with attractive interest rates that start at 10.50% p.a.

Home loans with terms of up to 30 years are available from the house financing firm. The processing fee that is levied for a DHFL home loan begins at Rs. 5,000 in addition to any applicable GST. A home purchase demands careful financial preparation. You’ll need to maintain tabs on your finances once you’ve been given a home loan to make timely EMI payments.

DHFL aims to offer the lowest interest rates for a home loan which, in the long run, makes a big difference in your overall budget. However, only income does not fulfill the eligibility criteria alone. The applicant, if he is salaried, must have experience and regular flow of salary of more than 2 years.

The only difference between the two is the rate of interest and the tenure of loan with the former being higher and the latter being lower than the other home loans for Resident Indians. Home Construction Loans – Often there are people who have a dream of a house and own land too. With DHFL Home Construction Loans, they can get an easy loan for completing the construction of their house. DHFL’s rates of interest are dynamic and vary according to market conditions. The rates of interest on home loans in India are usually calculated either on Monthly Reducing Balance or Yearly Reducing Balance.

Correct and legit documents ensure easy and smooth loan approval. Thinking of taking a loan may seem daunting and even if you decide to go through the process to get yourself your own house but there is one thing more which needs to be taken care of – Trust. The applicant is advised to go through all the content carefully and use the Eligibility Calculator to establish his eligibility for that particular home loan type. However, applicants are highly advised to make a decision regarding the property they wish to purchase and also acquire required approvals for the same. Living abroad does not mean that you have to be left dreaming about having a home.

All families having income of Rs 3 lakh to Rs 18 lakh are eligible under this scheme. For list of statutory towns eligible under the scheme visit the official website of National Housing Bank. Home loans are available for individuals working abroad but willing to own a residential property in India.

I need following home loan account closing statement from 2016 to 2018 its very emergency kindly do the needful. Kindly message us your mobile number and loan account number so that we can contact you. We understand that our customer care team has looked into your query and provided the best possible resolution via email. We hope we have been able to clarify the concern raised by you.

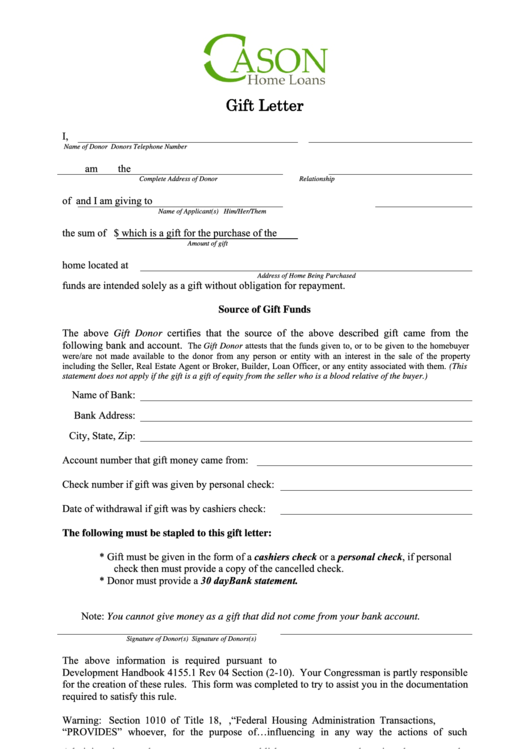

Also, it readily helps you easily understand all the financial implications if you are planning to pre-close your home loan. You can obtain a home loan interest certificate from your bank via a simple process that you can complete online from the convenience of your own home. Most financial institutions now provide consumers with straightforward online access to interest certificates. Income Documents Last 6 months Salary slips and Form No.16 . Last 3 years income tax returns, P/L account, Balance sheet and all other necessary documents along with financials (For self-employed). Top up Loan is additional loan over and above base home loan available for balance transfer cases to existing customers.

No comments:

Post a Comment